Top of Page

Previous page | ToC | Next page

The Audit of Environment Canada Costing and Pricing Processes (initially, Vote Netted Revenues) was included in the Department’s Risk-Based Audit and Evaluation Plan for 2008–2009 and approved by the Deputy Minister in July 2008.

During the planning phase of the audit, a risk analysis was conducted in order to determine and identify the key risks. The analysis was based on interviews with senior management and a documentation review. Concerns were raised regarding the way in which the Department charges its clients. Based on this, it was decided to change the scope of the audit to focus on costing and pricing processes instead of the Vote Netted Revenues.

Costing is the action taken to determine the value of the resources consumed in producing a product or delivering a service. The information derived from costing will support many types of business management decisions such as measuring performance, aligning resources to results, evaluating efficiency, and reallocating resources. Consultation between finance personnel and program managers is essential to the production of quality costing information. The Assistant Deputy Minister, Finance and Corporate Services Branch is responsible for providing functional direction and guidance to both senior management and program managers as required (e.g., how to calculate indirect costs).

Pricing is the action taken to determine what a charge should be or whether it is appropriate to make a charge. It takes into account a number of factors, such as fairness and equity, economic impact on clients, and competition with private sector suppliers. There are no specific policies for pricing. In order for program managers to undertake pricing decisions, they must know their program costs.

In March 2008, the Treasury Board of Canada Secretariat developed a Guide to Costing,5 hereinafter referred to as the Guide, which outlines a seven-step approach to costing. The Guide must be used for all costing exercises. It provides guidance and practical advice on preparing costing information and is used for a multitude of financial management decisions. Costing supports legislation and numerous policy instruments; it supports both departmental and central agency cost information, and contributes to accountability and transparency as well as to strengthened decision-making and informed risk-taking.

The Office of the Comptroller General of Canada, through Round VI of the Management Accountability Framework,6 has requested that departments report and provide an update on the early adoption and proactive implementation of the Guide.

The Department uses costing methodologies when preparing Memoranda to Cabinet, Treasury Board Submissions and when recovering costs for services provided to third parties. Costing methodologies are also used to develop agreements with clients or partners in revenue regimes or joint ventures, as well as developing appropriate charges for products and services. Costing is also used to determine annual budgets of ongoing operations, as well as regular budget transfers or funding transfers.

Over the years, Environment Canada developed several policies, guidelines and tools to assist managers in their costing and pricing activities. However, these tools were developed prior to the release of the Guide and are now outdated.

The Department’s revenues for fiscal year 2007–2008 totaled approximately $80.1M out of which $74.8M was included in the scope of the audit. The majority of the revenues are generated by the Meteorological Service of Canada. Table 1 presents the revenues generated by each branch during 2007–2008:

Branch |

$ (millions) | % |

|---|---|---|

| Meteorological Service of Canada | $58.00 |

77.5% |

| Science and Technology | $5.86 |

7.8% |

| Environmental Stewardship | $5.78 |

7.7% |

| Regional Director General | $3.07 |

4.1% |

| Chief Information Officer | $1.48 |

2.0% |

| Finance and Corporate Services | $0.58 |

0.8% |

| Other branches | $0.05 |

0.1% |

| Total | $74.82 |

100.0% |

Source: Departmental Financial System

Of the $80M collected, $66.5M (83%) was respendable7 and $13.5 million (17%) was collected and deposited to the Consolidated Revenue Fund. Respendable revenues are made available to program managers to support their activities.

Environment Canada provides goods and services to both other government departments (27% in 2007–2008) and external clients (73% in 2007–2008) and derives revenue through the recovery of costs and user fees.

The Department receives its authorities to generate revenues through specific acts, such as the Financial Administration Act, Canadian Environmental Protection Act and other regulatory authorities subject to the User Fees Act. The following table lists the Department’s authorities and fee categories.

Scientific and Professional Services

Information products

Source: 2007–2008 Departmental Performance Report

Table 3 presents the main categories of revenues for fiscal year 2007–2008 included in this audit:

| Revenue Category | Revenue Description | $ (millions) |

|---|---|---|

| Sales of goods and information products | Such as: data extracts and access; publications; hydrometric and weather products | 43.56 |

| Services of a non-regulatory nature | Such as: scientific and professional services; third party agreements; miscellaneous revenues | 21.50 |

| Services of a regulatory nature | Ocean disposal permit applications and monitoring fees; New chemical notification; Migratory Bird Hunting Permits and Stamps; Taxidermy and Aviculture Permits; Other permits and fees | 5.14 |

| Lease and use of public property | Accommodation | 4.62 |

| Total | 74.82 |

|

During the planning phase of the audit, a risk analysis was conducted based on interviews with departmental senior management, central agency representatives specializing in costing and pricing and the examination of documentation, including previous audits related to the same subject.9 The risk analysis revealed that the Department’s larger clients such as NavCanada, National Defence and Canadian Coast Guard are less at risk than the smaller clients, due to the fact that they are better documented and are subject to more scrutiny by senior management (see Table 2 for amounts generated in 2007–2008). Larger contracts and Memoranda of Understanding represent $45.8M (66%) of the total $69.9M.

The main concerns identified during the analysis were that:

In addition, the Department may not be consistently charging its clients. This may be perceived by the public as unfair and inequitable.

The objectives and scope of the audit were developed based on the risk assessment discussed in Section 1.2 of this report. The objectives of the audit were to provide assurance that:

The scope of the audit focused on 2007–2008 revenues, across the Department, for which a costing exercise is performed by program managers to determine the price to charge their clients. It should be noted that new guidance was provided by the Treasury Board Secretariat in May 2009 on pricing (Guide to Establishing the Level of a Cost-Based User Fee or Regulatory Charge). This guidance was not taken into consideration in this audit as it would have not been in effect nor of relevance to the management of revenues in 2007-08. Furthermore, the audit field work was completed before May 2009.

Given the results of the preliminary risk analysis and available resources, the audit did not include a verification of the costing calculations performed by program managers and where applicable, whether they were in compliance with the Acts.

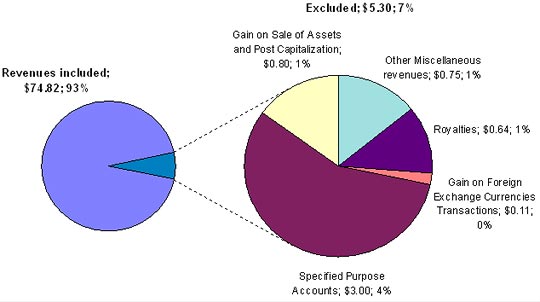

Revenues that do not require a costing exercise, such as gain on foreign exchange currencies and asset sales, as well as other miscellaneous revenues such as interest, Access to Information requests, parking, etc., were excluded from the audit. In addition, revenues from cost sharing / joint projects related to specified purpose accounts were also excluded as they are covered under a separate audit. Royalties, which are not material, were also excluded.

Since this audit focussed on costing and pricing for revenue generation, the costing for the creation of new programs (Treasury Board Submissions and Memoranda to Cabinet) was not part of the audit scope.

Source: 2007–2008 Departmental Financial Statements

Figure 1 shows the low materiality of the revenues that have been excluded from the audit (low materiality; no costing exercise required).

Annex 1 sets out the audit criteria that were developed for this audit.

The audit also included a follow-up on specific recommendations from two previous audits on similar subjects.

To address the objectives, the audit team reviewed documentation that was received from subject matter experts, program managers and Treasury Board representatives. In addition, a global data analysis of the revenues from the departmental financial system was performed.

Treasury Board and departmental policies, procedures and guidelines were reviewed. Departmental policies, guidelines and tools relating to costing were gathered and compiled in order to determine what tools the Department has in place, which ones require updating, and to identify any tools that need to be developed. A list of documents examined during the audit is attached in Annex 2.

A report was run and uploaded from the departmental financial system into a database using computer-assisted audit tools. A random sample of twenty-five records was selected. The sample was reviewed to ensure that various cost centers, revenue types, and internal and external fees were selected throughout the Department. From the representative sample, eighteen program managers were identified, interviewed and asked to provide supporting documentation.

The purpose of the interviews was to assess the consistency of costing practices across the Department. They also provided information on the tools used by program managers to conduct costing exercises, such as models, spreadsheets and guidelines. Evidence of the costing methodology and pricing rationale was requested during the interviews.

Interviews were also conducted with the Finance and Corporate Services Branch financial advisors and Treasury Board of Canada Secretariat specialists involved in costing and pricing in order to identify the tools currently in place and to determine what is required of the Department to implement the Guide.

This audit has been conducted in accordance with the International Standards for the Professional Practice of Internal Auditing and the Policy on Internal Audit of the Treasury Board of Canada Secretariat.

Along with our professional judgement, sufficient and appropriate audit procedures have been conducted and evidence gathered to support the accuracy of the conclusions reached and contained in this report. The conclusions are based on a comparison of the situations, as they existed at the time, against the audit criteria.

5 www.tbs-sct.gc.ca/fm-gf/ktopics-dossiersc/fms-sgf/costing-couts/menu-eng.asp

6 Environment Canada Round VI MAF Assessment Feedback to TBS: Effectiveness of Financial Management and Control – 17.6 Organizational Initiatives in Financial Management Questionnaire

7 Generated under the authority of the vote wording and in accordance with the Treasury Board Policy on Special Revenue Spending Authorities

8 This contract was renegotiated in 2009, after the completion of the field work for this audit. Source: Financial System and 2007–2008 Departmental Financial Statements

9 Meteorological Service of Canada Audit of Weather and Environment Predictions Projects Costing-Pricing Practices, dated November 2004 and Environment Canada’s Commercial Services Cost Recovery and User Charging Report, dated November 1999